You’ve bought a decently large bag of “long-term SOL, and you’d like for it to do more than just sit in your wallet while you hold it, so you decide to stake it.

To do that, you have to give up access to your tokens for at least two days to stake and two more to unstake.

Seeing this, you conclude that it’s not worth it.

And you’d be right. You’d have to be Warren Buffet to be excited about 8%.

But what if you could stake, still use your tokens, and farm airdrops along the way?

That’s the proposition of Liquid Staking and it’s by far the best way to stake for anyone who’s not a billionaire.

In this article, I’ll break down what liquid staking is, why it’s so much better than native staking and how you can use it to earn yield.

I’ll also discuss Stake Pool Liquid Staking Tokens (SP-LSTs), which have even more benefits than normal LSTs.

I’ll also include those airdrop strats I mentioned.

If you have no idea what staking even is, don’t worry; I’ll break it down from the start.

Let’s get into it.

Outline

Liquid Staking (jump here if you’re already familiar with staking)

What is Liquid Staking?

To answer this question, we need to first discuss staking.

You’ve probably heard staking is “locking up your tokens to secure the network,” but what is it really?

To understand staking, we need to go back even further to Blockchain 101.

If you recall, a blockchain is a permissionless, decentralized, distributed ledger.

That basically means anyone can download a copy of the blockchain, update it and tell everyone it’s the most recent version.

The problem with this system is that we need a way to check that the update is legitimate, i.e., it doesn’t contain any false data.

That's where the decentralization part of blockchain comes into play.

Every time an updated version of the blockchain is proposed, all the other nodes on the network check it. If they agree that it’s true (consensus), it becomes the main chain; if they don't, it’s rejected.

This sounds waterproof but it isn’t (yet).

Because blockchains are anonymous, there’s nothing stopping a bad actor from creating infinitely many nodes pretending to be different entities and using them to influence the acceptance of his proposed update.

This is called a Sybil attack.

That’s where consensus mechanisms come into play.

A consensus mechanism is a program with stipulated rules that helps us agree on the state of and updates to the blockchain.

The OG consensus mechanism is Proof-of-Work, but today we’ll be looking at Proof of Stake.

Proof of Stake

Proof-of-Stake’s approach to preventing Sybil attacks is to force nodes (called validators) to put up money to vote. This act is called staking.

The more stake you put up, the more voting power you have.

Staking effectively counteracts sybil for two reasons:

the attacker needs to put up a lot of money to attack the network.

whenever the attacker is discovered, its stake is slashed; this could mean confiscation or destruction of part or the entirety of its stake.

So Proof-of-Stake makes it very hard and very risky to influence the network.

If you’re wondering why anyone would put up money to vote, it’s because validators get paid for securing the network. And these rewards can be quite substantial.

Moving on, Solana runs a version of Proof-of-Stake called Delegated-Proof-of-Stake (DPoS)

DPoS

Delegated Proof-of-Stake is just like Proof-of-Stake, except validators don’t need to actually own the staked tokens.

Token holders (you and I) can delegate the power of our tokens to validators.

We still own the tokens; we just put their weight behind the validator. Since we own the stake, we also own the rewards (minus the validator’s commission.)

You might be thinking, “Doesn’t that put me at risk of slashing?”

Short answer: Yes, it does.

This is why:

you should only stake with validators you trust and

why it’s important that you stake at all.

The larger the total stake and the more spread out it is, the less likely anyone is to try anything malicious. Nobody in their right minds will attempt a provably doomed attack.

So to summarize everything so far, (delegated) staking is a consensus mechanism that involves locking up tokens to secure the network.

We’re back where we started but it should make more sense now.

So what exactly is liquid staking, and how does it work?

Liquid Staking and How it Works

The major impediment to native staking is the opportunity cost for token holders.

Locking up your tokens robs you of other earning opportunities and can even prevent you from fully capitalizing on pumps.

Staking only makes sense if you plan to leave your tokens for 10+ years.

Even then, at the highest return rate (~8%), staking for 10 years will only double your number of tokens.

So you'll have to wait 10 years to flip 1 SOL to 2.15 SOL and you’ll be unable to use the tokens throughout that period.

That might make sense for a billionaire who wants to leave a fortune for his children but for the rest of us, it’s a terrible bargain.

Enter liquid Staking.

In liquid staking, when you stake your tokens, you get a special token called an LST (Liquid Staking Token). An LST represents your staked tokens and can be used to redeem them.

This gives it essentially the same financial value as your tokens.

You can’t pay for transactions like you would with the base token but you can use the LST for anything else.

The two ways LSTs are majorly used are:

As capital for lending

For LPing.

We’ll talk more about these later. But the key idea behind liquid staking is that it allows you to eat your steak and have it.

Why you should use Liquid Staking

Aside from getting to eat your cake and have it, liquid staking is beneficial for the entire ecosystem: users, validators and even the network.

Benefits for Users

The main benefit of LSTs for users is the reduction in opportunity costs.

LSTs can be traded directly for the base token so there’s no staking/unstaking time

In addition, you can use LSTs in DeFi to earn additional yield and some LSTs also allow you to earn airdrops.

Benefits For validators

LSTs also help validators attract more stake.

A validator with an LST will naturally attract more stake than one without (all else being equal).

Benefits for the network

LSTs are also great for the network because:

They lower the friction to staking and make the network more secure

They supercharge DeFi because more capital is available.

In summary, liquid staking is great for everyone.

So how does it work?

How Liquid Staking Works

Liquid staking is a very simple concept.

You deposit your Solana into a smart contract and get LSTs in proportion to the amount of Solana deposited.

You might expect that 1 LST = 1 SOL but no.

LSTs distribute staking rewards by increasing the value of the LST relative to SOL.

So the value of an LST will continue to grow relative to SOL.

When you want to redeem your SOL, you can either:

Swap between both tokens on a DeFi platform like Jupiter or

Unstake from the LST provider directly

Since your LST grows relative to SOL, when you swap or unstake, you’ll get more SOL for the same amount of LST. And that’s how you get your rewards.

Now that you understand liquid staking, here’s how to make the most of it:

Liquid Staking Protocols

There are currently seven reputable liquid-staking protocols on Solana:

Marinade (mSOL)

Blaze (bSOL)

JPool

Cogent Crypto (CGNTSOL)

Jito (JitoSOL)

Laine(LaineSOL)

MarginFi

The first two (mSOL, bSOL) are the LSTs for Solana’s reputable stake pools.

We’ll focus on them going forward. The other four are not bad but they don’t offer any other benefits aside being LSTs. Stake pool LSTs have all that functionality and are so much better for the network.

But what is a stake pool?

A stake pool is exactly what it sounds like; it’s a protocol where delegators band together to stake tokens.

Stake pools are important for three reasons: simplicity, decentralization and risk management.

Simplicity

Native staking isn’t difficult but knowing what validator to stake with can be extremely difficult.

The performance metrics for validators, like skip rate, average number of credits, commission, etc., make it difficult to evaluate validator performance. In addition, monitoring your validator’s performance and honesty after staking is also important.

All this complexity usually leads to “just staking with one of the big ones” which centralizes the network.

Stake pools are designed to abstract this complexity away.

They algorithmically select and monitor validators in a way that maximizes profit and decentralization.

Which brings us to point two:

Decentralization

Like I mentioned earlier, most delegators (I’m also guilty of this) see 8% APY, and we tell ourselves it’s bigger than 7% APY,network, but and we stake with the 8% validator.

This not only centralizes the network, it does so with minimal rewards.

Over 10 years, 7% and 8% amount to 0.98 and 1.15 ROI, respectively.

It’s literally peanuts at the cost of making the network more fragile.

Stake pools fix this by actively pursuing decentralization without sacrificing RoI.

Risk

Stake pools lower risk through diversification.

Since they don’t stake with single validators, they minimize the impact of a validator going offline or the risk of slashing due to malicious activity.

In summary, stake pools are great

But there’s a question: Which one is best?

For most people there’s two options: Marinade and Blaze. We’ll discuss why Blaze is better next.

Why you should be using Blaze

Maximizes profit and decentralization

The primary reason I recommend Blaze to all Solana stakers is that it prioritizes decentralization more than any other pool. Blaze doesn’t only support small validators; it supports the largest number of validators for any stake pool (currently 281).

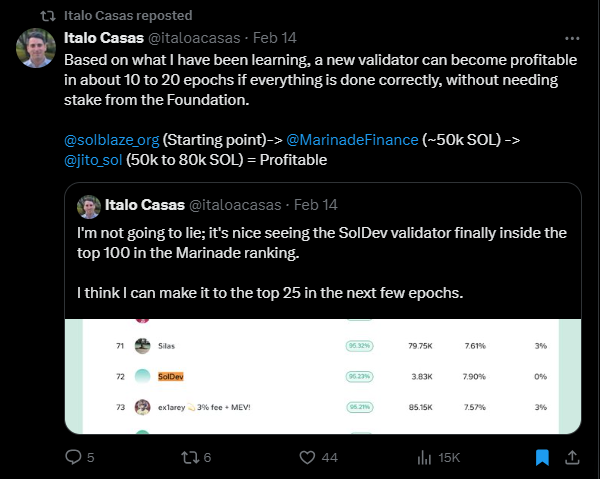

Marinade also supports small validators but validator consensus is that Blaze is the most friendly to validators just starting out.

And while its APY is slightly lower than other stake pools or delegating to a large validator, the difference is infinitesimal even over long time spans.

The difference between the Blaze pool and the validator with the highest APY (Blocksmith) is 1.023 to 1.183 ROI over ten years. It’s infinitesimally small.

Simply put, using Blaze is currently the best way to secure the network.

Secure and Non-Custodial

The question of security isn’t one that comes up if you don’t understand blockchain architecture but all you need to know is Blaze is as secure as can be.

The smart contract was written in collaboration with Solana Labs engineers and has been audited seven times by five different organizations. The contracts are as bulletproof as can be.

Instant staking and unstaking

This might not make sense to you if you’ve never staked before: but native staking changes can not be effected within an epoch i.e your staking or unstaking can not occur until an epoch begins or the current one ends. If you’re unlucky, you could be waiting as long as two days before you can stake or unstake.

With Blaze, staking or unstaking can be done instantly.

Airdrops

Using Blaze currently positions you for multiple airdrops:

Blaze airdrops their governance token ($BLZE) to bSOL holders

It’s also possible to farm multiple DeFi airdrops like Kamino and Meteora but we’ll discuss these later.

You maintain control

Blaze also allows delegators to fully control what validators get their stake

This allows users to support any validators and still get the functionality of an LST.

Minimal Fees

SolBlaze charges minimal fees to support their operations.

You can find a full breakdown here.

Ecosystem Support

Aside its stake pool, Blaze operates three other utilities

Blaze runs a mainnet faucet (yes, you can get free mainnet SOL).

Blaze also has a token minter that allows anyone to mint a token on Solana and

Lastly, Blaze has a Solana Payments Software Development Kit (SDK) to help developers integrate Solana payments into their projects.

Supporting SolBlaze is supporting the ecosystem in more ways than one.

How does Blaze work?

Blaze has three major parts (or features):

Algorithmic Staking

Most of what has been discussed so far has been the algorithmic staking portion of Blaze's activities.

The stake pool is divided into two parts: 90% of the total stake pool is reserved for algorithmic staking. Of the 90%, 99.8% is staked and 0.2% is reserved for instant unstaking.

There is a deterministic algorithm that delegates the funds in the stake pool in a way that maximizes APY and decentralization.

The exact delegation strategy can be found here

BLZE gauges

The rest of the stake pool (10%) is controlled by $BLZE gauges.

$BLZE is the governance token of Blaze and it can be used to direct stake to any validator of your choice. It can also be used for BLZE DAO governance (more details on that here.)

Custom Liquid Staking (CLS)

CLS allows delegators to delegate their tokens directly to specific validator(s) within or outside the stake pool and get LSTs for them. This is great because it allows delegators to support specific validators and enjoy all the benefits of an LST.

These three components make up Blaze. We’ll be moving on to the fun part now: How to use Blaze.

How to Stake on Blaze

To get started staking on Blaze

go to the website

connect your wallet and sign in

scroll to the bottom of the page, enter the amount you wish to stake and click stake

approve the transaction and you should get this pop-up.

You now have bSOL in your wallet.

To unstake, head over to the same webpage and click on the instant or delayed unstake option and follow the process. It’s as easy as 1234.

Now that you have some bSOL, let’s look at how to maximize bSOL

How to use bSOL

Staking SOL for bSOL rewards you with $BLZE but there are two other ways to ramp up your yield: LPing and Lending.

Liquidity Provision

Liquidity Provi(son/ding) is an entirely different topic and if you want to learn it, I’ll link to a resource at the end. But here’s a quick summary:

As a liquidity provider, you deposit an equal value of two tokens into a pool.

When people want to swap between those tokens, they use your pool and pay you a small fee for it. The more people use your pool, the more fees you earn.

You can find these pools on platforms like Meteora.

To benefit from this, you just have to:

Stake some SOL with Blaze

Go to Meteora and select a bSOL pool

Deposit equal value of bSOL and your chosen token

Earn fees and $BLZE

I’d like to warn you that LPing comes with the risk of impermanent loss so make sure you DYOR.

Lending

Another way to use Blaze is to lend bSOL on a lending platform like Kamino/MarginFi.

You’ll earn some APY from lending your LST and you can borrow against it.

I personally find this very helpful when I’ve staked all my SOL and suddenly need SOL or USDC for a mint or something else.

Again, be careful with borrowing because you could get liquidated if your collateral value falls below a threshold relative to your borrow position.

In general, borrowing SOL against bSOL is safe since bSOL is in a sense pegged to SOL but DYOR before investing.

Those are the standard approaches to using LSTs in DeFi but let’s turn our attention to meta ways to use bSOL and farm airdrops along the way.

Airdrop Farming with bSOL

There are currently a lot of DeFi airdrops on the horizon: Meteora, Kamino, MarginFi, Jupiter, etc.

Using Blaze in the right ways allows you to position yourself for most of them.

Here are some of my favorite plays:

Farm Kamino points, Meteora points and $BLZE

Kamino’s vaults have integrated Meteora’s DLMM technology.

By depositing into a bSOL vault with a Meteora marker you can stack $BLZE, Met Points and Kamino points in addition to your yield from staking and the APY from Kamino.

That’s five incentives and three airdrops in one play.

Here’s an example:

The JUP/bSOL vault

By depositing into this vault, you’ll earn $BLZE, Met Points, Kamino Points and Yield.

Use Meteora’s new DLMMs with the bSOL/SOL pair

This is one of my favorites because of how “capital-efficient” DLMMs are.

Using a pair like bSOL/SOL where relative volatility is non-existent just makes it so much better.

If you’re not familiar with DLMMs, I’ve attached a resource at the end.

3-in-1 airdrop strat using $JUP

$PYTH rewards from Kamino

QuadStake, farm $JUP and $MRGN

That makes 5. At this juncture, you have all you need to maximize your yield and airdrop farming.

Conclusion

Blaze allows you to get all the benefits of liquid staking while decentralizing the network and farming airdrops at no extra cost. There is no logical reason for anyone looking to stake not to use Blaze.

Further Reading

References

https://analytics.topledger.xyz/tl/public/dashboards/1f5RBu3NSjEQFqOp7wcifeIYd432Uv1pG4Kk17aj

https://dune.com/cz_5052/etherum-eth

https://dune.com/ilemi/solana-staking

https://solblaze.org/

https://stake-docs.solblaze.org/

https://stake-docs.solblaze.org/protocol/security-overview

https://solanacompass.com/validators

https://twitter.com/solblaze_org/status/1688480241000579072?s=20

A very beginner friendly and comprehensive guide👏👏👏